Governance

Corporate social responsibility

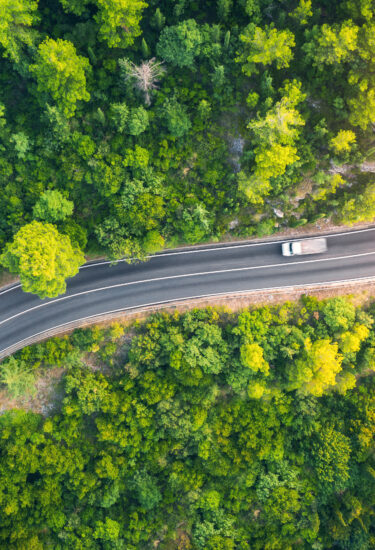

Q-Free’s purpose is to help society and customers tackle mobility, safety, and environmental challenges related to traffic and help sustain urban growth and quality of life. This is the focal point of everything we do and is underpinned by our 3 strategic solution offerings Q-Flow (for improved mobility), Q-Safe (for increased traffic safety), and Q-Clean (for environmentally-friendly transportation).

Q-Free Corporate Social Responsibility Review 2022

Transparency Act Report

Code of conduct

Q-Free has a code of conduct which aims to provide guidance to our people for a common platform. The code of conduct is instrumental for Q-Free’s approach to human rights, fair working environment, health and safety, business ethics and anti-corruption.

Q-Free Business Partner Declaration & Questionnaire